Great investors and their Bazi profiles

Great investors are like the rock stars of the financial world and have all made a fortune off of their success and in many cases, they’ve helped millions of others achieve similar returns. They differ widely in the strategies and philosophies they applied to their trading. Where these investors don’t differ is in their ability to consistently beat the market.

I have picked some of these great investors, including Sir John Templeton, John Neff, John Bogle, Warren Buffett, Carl Icahn, and Bill Gross to analyze what are the important common Bazi elements they have in their charts. I noted the following common elements –

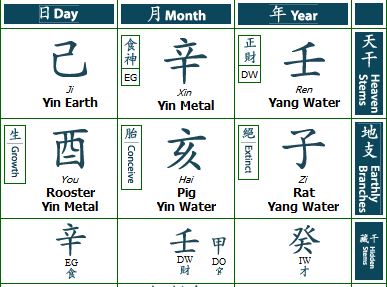

- There are Wealth (DW/IW) elements in the month and or year pillar as the month pillar represents career/business and the year pillar represents the market, and industry. The charts of John Templeton, John Neff, and John Bogle have strong wealth elements in their month and or year pillars.

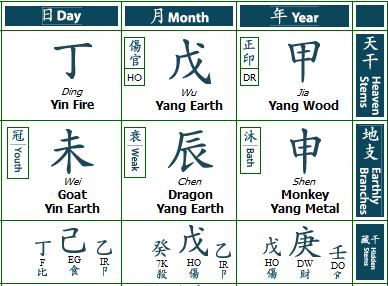

- There are Resource (DR/IR) elements in the month and or year pillar. Direct Resource (DR) represents the ability to analyze facts and figures and Indirect Resource (IR) is the ability to understand and read market/industry trends and patterns. The charts of Warren Buffett, Carl Icahn, and Bill Gross have strong resource elements in their month and or year pillars.

From the above analysis, it is noted the above great investors have wealth and or resource elements in the month and or year pillar of their charts.

Please print your Bazi Chart here.

John Templeton

Templeton created some of the world’s largest and most successful international investment funds. “Money” magazine in 1999 called him “arguably the greatest global stock picker of the century” Templeton attributed much of his success to his ability to maintain an elevated mood, avoid anxiety and stay disciplined. He rejected technical analysis for stock trading, preferring instead to use fundamental analysis.

John Neff

Neff referred to his investing style as a low price-to-earnings (P/E) methodology. He was considered a value investor as he focused on companies with low P/E ratios and strong dividend yields. He was notable for his contrarian and value investing styles as well as for heading Vanguard’s Windsor Fund. Windsor became the highest returning and subsequently largest mutual fund in existence during his management.

John Bogle

Bogle founded the Vanguard Group mutual fund company in 1975 and made it into one of the world’s largest and most respected fund sponsors. Bogle pioneered the no=load mutual fund and championed low-cost index investing for millions of investors. He created and introduced the first index fund, Vanguard 500, in 1976. Jack Bogle’s investing philosophy advocates capturing market returns by investing in broad-based index mutual funds that are characterized as no-load, low-cost, low-turnover, and passively managed.

Warren Buffett

Referred to as the “Oracle of Omaha,” he is viewed as one of the most successful investors in history. Following the principles set out by Benjamin Graham he has amassed a multibillion-dollar fortune mainly through buying stocks and companies through Berkshire Hathaway. Those who invested $10,000 in Berkshire Hathaway in 1965 are above the $165 million mark today.

Carl Icahn

Carl Icahn is an activist and pugnacious investor that uses ownership positions in publicly held companies to force changes to increase the value of his shares. Icahn started his corporate raiding activities in earnest in the late 1970s and hit the big leagues with his hostile takeover of TWA in 1985.

Bill Gross

Considered the “king of bonds,” Bill Gross is the world’s leading bond fund manager. As the founder and managing director of the PIMCO family of bond funds, he and his team have more than $1.92 trillion in fixed-income assets under his management.

Do you have wealth or resource elements in your month or year pillar or both pillars? If yes, there is potential for you to become a great investor. However, you still need to attend investment courses to learn the skills of investing as investments need both luck and skills.

If you want to get your personalized Bazi report on your career, wealth, relationship, and health you can click on this link finding out what your chart means.

Please click here and like Digidentz on Facebook and also help to share my blog with your friends. Thank you